Tons of Value Packed Into Self-Storage Property: What You Need to Know

Opportunities abound for self-storage, making it an asset class that shouldn’t be overlooked. This holds especially true for investors seeking to compound wealth and grow the net worth of their portfolio because of the flexibility and adaptability of the asset. Unlike other, more fixed-use type asset classes, self-storage can take on many different shapes, meaning the property can be quickly and easily adjusted depending on location, local needs, and changing market conditions.

Why Do Investors Like Self-Storage?

At SIG, we specialize in working with our clients to find the best investments based on their capital goals, and self-storage is often a top contender. Here’s why:

- The Ability to Control and Adjust Income

Self-storage leases are typically month-to-month and income is spread over many tenants at one location. This means owners see the results (in terms of increased rental income) of any improvements they make very quickly. Additionally, in the worst-case scenario of a default, owners have access to the assets stored as collateral limiting their risk and potential loss of income.

- Operational Costs

Operational costs are relatively low. Lower overheads, with operating expense ratios ranging from 20% to 40%, mean owners can keep self-storage businesses profitable even in economic downturns. And when the market improves, self-storage becomes extremely profitable. Because many expenses are fixed and predictable, growing in size does not have a one-to-one impact on monthly costs but instead creates a larger spread between gross income and expenses, increasing the potential profitability of the property.

- Recession Resilience

Self-storage’s flexibility and adaptability to changing market requirements makes it resilient during a recession. People downsizing, moving homes or apartments, or storing excess inventory as a business shrinks, drives the use of self-storage. Not to mention that it’s considered the most affordable way to store items whether in the short, medium, or even long term.

What Do You Need to Know Before Investing in Self-Storage?

Self-storage is an investment that requires owner involvement. This is why many properties enter the market: current owners are ready to shift to a more passive CRE investment. Further, the self-storage market in the US is still highly fragmented, with room for maturation and concentration.

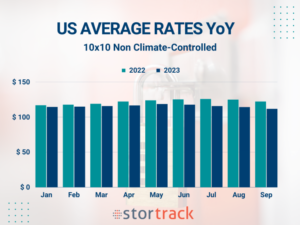

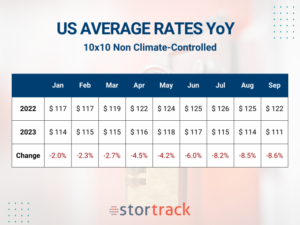

If you research self-storage today, you might be alarmed to see headlines talking about declining rental rates and increasing vacancy rates. And while this is true on average, self-storage rates across the US have declined by 2% to 8%+ year-on-year after the pandemic (see table 1), our brokers work hard to identify the diamond in the rough opportunities that definitely exist.

Table 1

A perfect example is one of our recent listings, Elkridge, Maryland-based 495 Movers Storage. SIG advisor, Goral Khatta, who specializes in storage and is based out of our Charlotte, North Carolina office, points out that storage space is scarce in this area, due to building regulations and lack of appropriately zoned land. This, plus the upcoming residential boom and increase in transport links in the county, make this a solid opportunity for investors looking at self-storage.

Additionally, Jim Blanda, storage specialist advisor in our Fort Lauderdale, Florida office highlights the opportunity in RV and boat storage. This is still a highly fragmented and underdeveloped section of the self-storage market, but it is in high demand with many homeowner associations insisting that boats and RVs be stored off-site. With more people moving to Sun Belt towns and cities, Jim says there’s an interesting opportunity in boat and RV self-storage in these locations.

Finding the Best Self-Storage Deal

When looking to find the most attractive deal, these are the questions to ask yourself and your advisor:

- How saturated is the local market currently and what is the demand?

- How do the current rents at the property compare to market averages? And are these rates trending up or down?

- How will you manage the property on a day-to-day basis and what will this cost you?

- Which expenses will change if you buy the asset? For instance, insurance and taxes typically go up with a purchase.

- How does the property fit into your portfolio and longer-term strategic goals?

SIG self-storage experts can help you with accurate data and market insights to answer these questions and make sure you get the best deal for your wealth ambitions.

How Can SIG Help You Buy or Sell Self-Storage?

Whether you are looking for a self-storage business for sale or have self-storage units you want to sell, our experts in our national brokerage firm can help you find, accurately assess, and consider each opportunity in terms of your specific goals. We’ll work with you to do the deal and then beyond that, as your property journey continues.

When it comes time to sell, we’ll help you achieve a fair market price for your property and then assist you with shifting your wealth to your next opportunity. A popular route out of self-storage is triple net lease via a 1031 exchange.

Transparency is key and we always tell you what you need to know instead of only what you want to know. Likewise, we never list properties unpriced. Our team of brokers works hard to actively match buyers with sellers and achieve the best deal for both.

And we do deals fast – in a few months not years. Because we work collaboratively, with a shared database, each property reaches more potential buyers. For instance, in the last month, we’ve had 1,300+ inquiries on 20 self-storage listings. We’ve sold more than $150 million in self-storage over the last two years, and currently have $100 million in assets on our books.

Book a meeting with our self-storage team at 2024 ISS World Expo in Las Vegas in April. Or swing by our booth #943.

Leave a Reply

Want to join the discussion?Feel free to contribute!